Carbon Capture and Markets via KlimaDAO

Screenshot via KlimaDAO

Story and History

KlimaDAO presents itself as a community that wants to “reward those who participate in financial activism for the climate” and to “develop and govern a carbon-backed currency that internalizes the cost of carbon and functions as a counter to the existing economic system”. Also, KlimaDAO presents itself as consisting of “environmentalists, developers and entrepreneurs aiming to combine their knowledge and experience to make a positive impact on carbon markets”.

KlimaDAO was historically “forked” from Olympus DAO with similar ReFi ambitions. Its system operates on an energy-efficient Ethereum layer-2 Polygon blockchain and KlimaDAO is cooperating with other carbon-based and pooling initiatives as in the case of Toucan.

Screenshot via KlimaDAO

Tokenomics and carbon markets

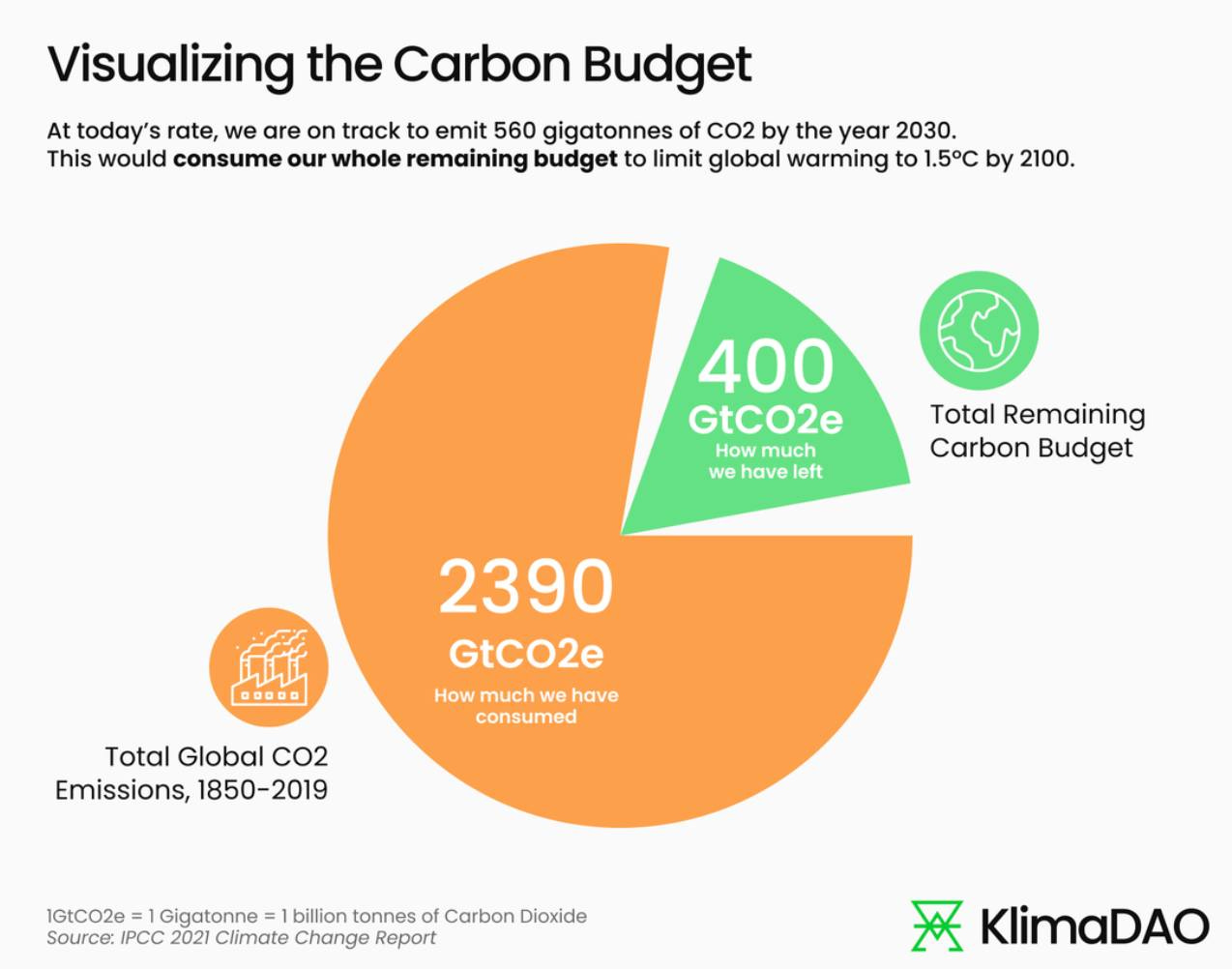

In general, the carbon market exists for trading carbon emission credits. The function of the carbon market is to provide economic and market-based incentives for emissions reduction. Each carbon emission credit represents the reduction or removal of 1mtCO2e (1 metric tonne of CO2 equivalent) from the atmosphere. At present, two types of carbon markets exist worldwide. There are the mandatory ones in the case of the European Emissions Trading System, and the voluntary ones in the case of KlimaDAO.

There are three main functions for KlimaDAO:

to be equal to the overall global carbon market price, and go up in value as selling carbon emission rights becomes more expensive

to create voluntary carbon markets, for those companies and initiatives that want to climate compensate

to tokenize carbon markets and contribute to tons of carbon reduction

KlimaDAO specializes in reducing carbon offset by using its tokens. The Klima ecosystem works in such a way that individuals and organizations can sell their carbon credits at a discount to Klima in exchange for newly minted Klima-tokens (this process is called bonding in the Klima ecosystem).

What happens is that Klima holders can “stake” their Klima, which locks Klima’s stake up in exchange for receiving a portion of newly minted Klima tokens (an action very similar to a stock split). Through these mechanisms, the supply of Klima inflates while an increasing amount of carbon is bought and stored in the treasury.

Screenshot via KlimaDAO

Participants in KLIMA staking can receive a profit distribution as an incentive for long-term KLIMA participation. This gives users exposure to rising carbon prices. KLIMA Bet Rewards are proportional to the amount of KLIMA tokens in a bet and the duration of the bet. Therefore, blocking more KLIMA tokens for longer periods will result in higher compound returns.

For each KLIMA token in the Klima stakeout contract, stakers receive “sKLIMA” tokens in a ratio of 1:1. The sKLIMA token is not officially available on any cryptocurrency exchange, making the asset virtually illiquid. However, sKLIMA can be transferred between wallet addresses. By removing staking, users can redeem sKLIMA tokens for an equal amount of KLIMA tokens.

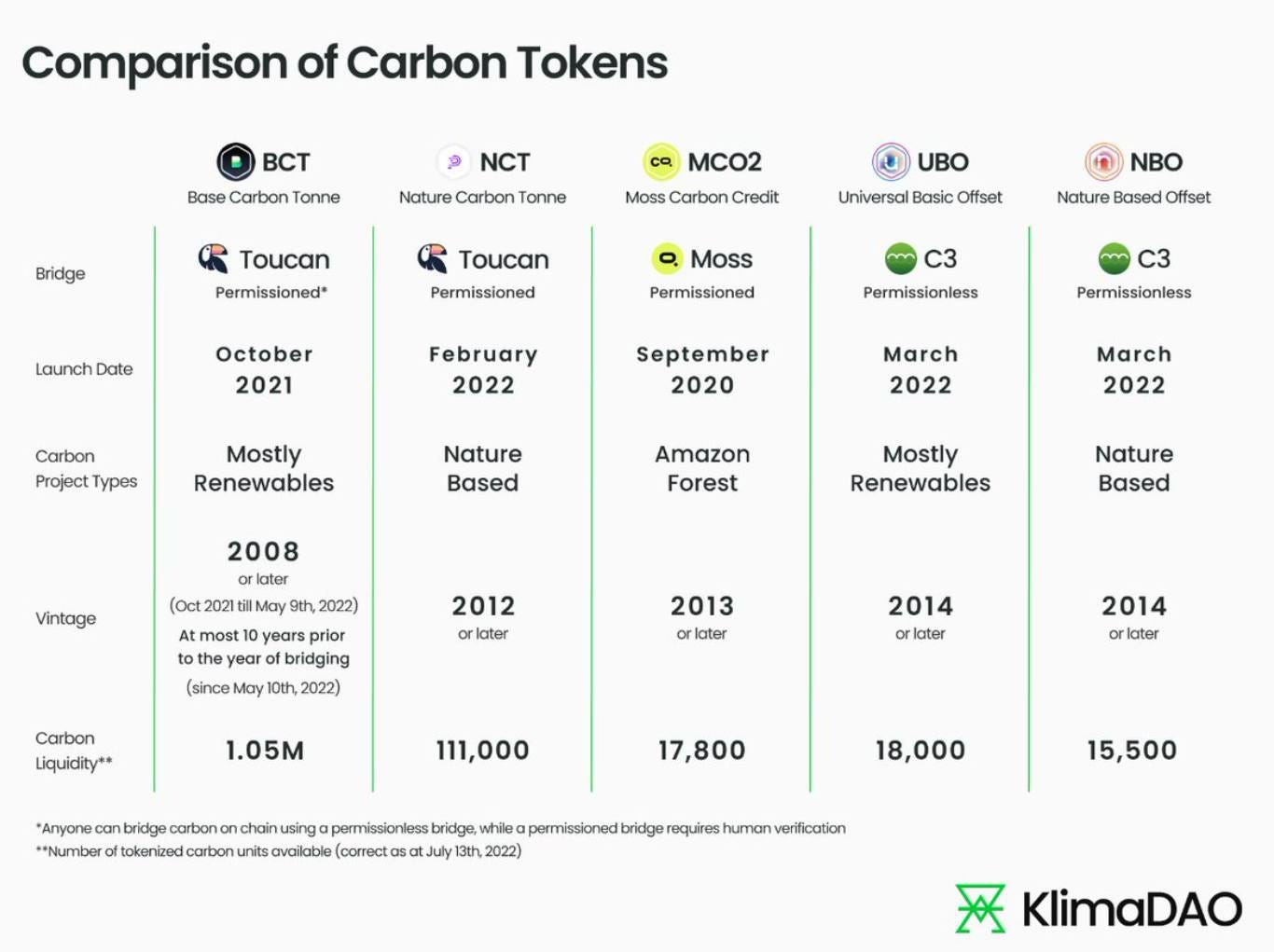

Regarding “tokenization”, the case is that every KLIMA token is backed by 1 $BCT (Base Carbon Tonne) token. At the same time, the KlimaDAO ecosystem creates value for its community via a “virtuous cycle” of economic growth. In practice, all economic activities within the ecosystem can later increase the KLIMA token supply while KLIMA tokens can only enter circulation when BCTs are removed from circulation and locked up in the KlimaDAO treasury.

Screenshot via Klima DAO

Price and currency

One can also say that tokenized carbon credits also function as a new reserve currency with a direct impact on climate change actions by reducing greenhouse gas emissions. KlimaDAO aims to add a layer of gamification to the carbon economy, encouraging projects and entrepreneurs to profit while reducing their carbon footprint. In January, it was reported that KlimaDAO was spending 100 million American Dollars on offsets, similar to the annual emissions of for example, Jamaica and Georgia.

Screenshot via KlimaDAO

The price of KlimaDAO is forecast to peak at $478.15 throughout 2022.

Already in 2023, according to our crypto price prediction index, in 2023 Klima DAO (KLIMA) may reach a maximum level of $920.17, with an average trading price of $684.28. While the project does not seek to establish a stable price for carbon in the short term, it does aim to create a better picture of what carbon markets in the chain should look like through voting and policy decisions

Screenshot Defi Lama

There is also criticism partly about the KlimaDAO system in general as similarities with Olympus DAO concerning Polygon operations and billionaire Mark Cuban, and partly toward the founders of KlimaDAO for not informing who they are and thereby not being transparent enough. Despite that, KlimaDAO is attracting new members and is so far one of the most established ReFi initiatives.

Thanks for reading. You can reward and support my content creation via:

Buy Me a Coffee - https://www.buymeacoffee.com/vladlau

Pay Pal – lauvlad89@gmail.com

Seeds – vladlausevic

Skycoin – ZxjhWMJRbTNCRQzy5MekZzH4fhdWFCqBP8

Bitcoin 3HbxyDXE9MhNQ8RqsirqgYvFupQzh5Xby2

Algo - NCG6LBALQHENQUSR77KOR6SS42FGK54BZ5L2HFDSBGQVLGYIOVWYDXFDI4

Swish – 0762345677 Tezos — tz1QrRzkTAKuPKF8dmGW6c1ScEHBUGvoiJBM